Who Has the Most? A Visual Exploration of American Net Worth by Age Group

Understanding your net worth at different life stages is crucial for effective financial planning. This article aims to visualize and analyze the net worth of Americans across various age groups, providing valuable insights into wealth accumulation patterns and financial milestones.

As someone who has worked in the finance industry for over a decade, I’ve witnessed firsthand the profound impact that net worth can have on an individual’s financial security and retirement planning. Throughout my career, I’ve advised countless clients on strategies to build and preserve their wealth, tailoring my recommendations to their specific age and life stage.

In this article, we’ll delve into the intricacies of net worth, exploring its definition, significance, and the factors that influence it. We’ll then embark on a visual journey, presenting a visually appealing chart that depicts the average net worth of Americans by age, highlighting key inflection points and patterns along the curve.

What is Net Worth, and Why Does it Matter?

Net worth is a comprehensive measure of an individual’s financial standing, calculated by subtracting total liabilities (debts) from total assets (investments, property, and other valuable possessions). In essence, it represents the total value of what you own minus what you owe.

Understanding and tracking your net worth is crucial for several reasons:

- Financial Security: A positive and growing net worth serves as a buffer against unexpected expenses and financial emergencies, providing a sense of security and stability.

- Retirement Planning: Your net worth directly impacts your ability to fund a comfortable retirement. By monitoring and optimizing your net worth throughout your working years, you can better prepare for a financially secure retirement.

- Wealth Building: Monitoring your net worth allows you to assess the effectiveness of your wealth-building strategies and make adjustments as needed to achieve your financial goals.

- Debt Management: A high net worth typically indicates a lower level of debt, which can reduce financial stress and interest payments, freeing up funds for other goals.

Your net worth is influenced by various factors, including your income, expenses, investments, and debt management strategies. By understanding these factors and making informed decisions, you can take control of your financial future and work towards building a healthy net worth.

Visualizing the Net Worth Curve: Age as a Catalyst

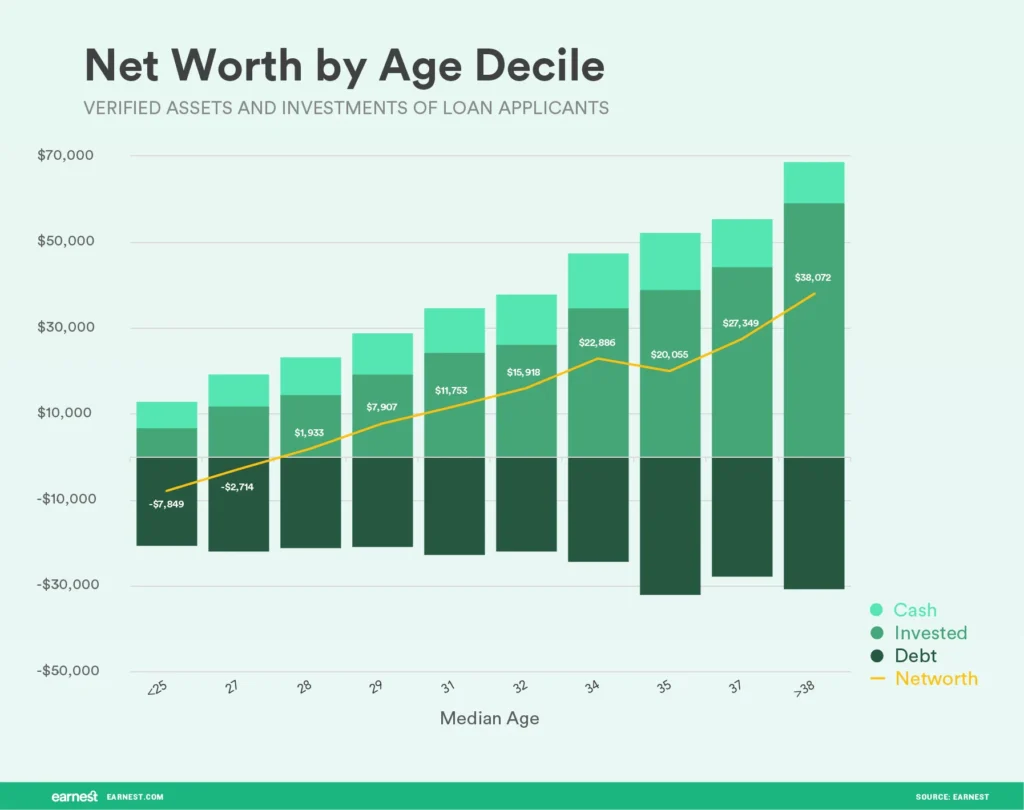

To better understand the relationship between age and net worth, let’s examine a visual representation of the average net worth of Americans by age:

This chart illustrates several key patterns and inflection points in the net worth curve:

- Early Years: In the early stages of adulthood, net worth tends to be relatively low or even negative due to factors such as student loan debt, entry-level salaries, and limited asset accumulation.

- Mid-Career: As individuals progress in their careers and begin to earn higher incomes, their net worth typically starts to increase rapidly. Home-ownership, retirement account contributions, and investment growth contribute to this upward trend.

- Peak Years: The net worth curve often reaches its peak during middle age, typically between the ages of 45 and 65. This period coincides with the highest earning potential, significant asset accumulation, and debt repayment.

- Retirement: After retirement, net worth may begin to decline as individuals start drawing from their savings and investment accounts to fund their living expenses.

The underlying reasons for these trends are multifaceted and can vary based on individual circumstances. However, some common factors include career progression, home-ownership, debt repayment strategies, and investment growth.

The Millennial Dilemma: Navigating Student Loans and Delayed Milestones

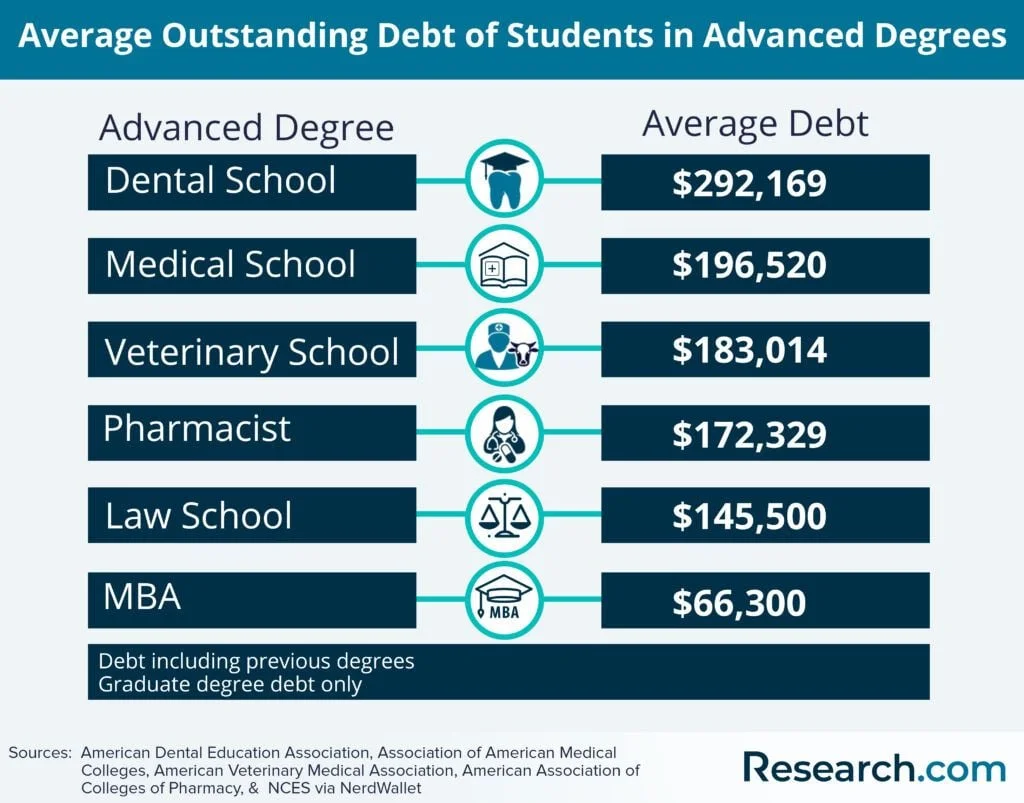

For millennial’s, the path to building net worth can be particularly challenging. This generation faces unique obstacles, such as the burden of student loan debt and delayed home ownership.

Student Loan Debt

According to the Federal Reserve, the average student loan debt for bachelor’s degree recipients in the class of 2020 was $28,400. This significant financial burden can hinder millennial’s’ ability to save and invest, effectively hindering their net worth growth in the early years of their careers.

To mitigate the impact of student loan debt, millennial’s should consider the following strategies:

- Income-Driven Repayment Plans: These plans can make monthly payments more manageable by basing them on a percentage of your income.

- Loan Forgiveness Programs: Explore programs like Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness, which can provide debt relief for those in eligible professions.

- Debt Consolidation: Consolidating multiple loans into a single payment with a lower interest rate can reduce the overall cost of the debt over time.

Delayed Home-ownership

Many millennial’s have delayed home-ownership due to factors such as high housing costs, student loan debt, and lifestyle preferences. This delay can have a significant impact on their net worth, as home-ownership is often a key driver of wealth accumulation.

To overcome this challenge, millennial’s should consider the following strategies:

- Rent vs. Buy Analysis: Carefully evaluate the long-term financial implications of renting versus buying a home in your area.

- Down Payment Assistance Programs: Research and take advantage of first-time home-buyer programs that can provide down payment assistance or closing cost credits.

- Alternative Housing Options: Explore alternative housing options, such as multi-generational living or co-ownership, to make home-ownership more accessible.

Retirement Planning for Millennial’s

Despite the challenges, it’s crucial for millennial’s to start planning for retirement as early as possible. The power of compound interest can work wonders, even with modest contributions.

- Employer-Sponsored Retirement Plans: Take advantage of 401(k) or 403(b) plans offered by your employer, and consider contributing at least enough to maximize any employer match.

- Individual Retirement Accounts (IRAs): Open and contribute to a traditional or Roth IRA to supplement your employer-sponsored retirement savings.

- Diversified Investment Strategies: Adopt a diversified investment approach that aligns with your risk tolerance and time horizon, focusing on low-cost index funds or target-date funds.

By addressing student loan debt, exploring home-ownership options, and prioritizing retirement savings, millennial’s can overcome the obstacles and build a solid foundation for long-term net worth growth.

The Peak Years: Maximizing Net Worth in Middle Age

For many individuals, middle age represents the peak years for net worth accumulation. During this period, several factors converge to create optimal conditions for wealth building.

Home-ownership

Home ownership is a significant contributor to net worth growth during middle age. As mortgages are paid down and home values appreciate, the equity in the property represents a substantial portion of an individual’s net worth.

To maximize the benefits of home-ownership, consider the following strategies:

- Accelerated Mortgage Payments: Making additional principal payments or refinancing to a shorter-term mortgage can help you build equity faster and reduce overall interest costs.

- Home Improvements: Strategic home improvements and renovations can increase the value of your property, further boosting your net worth.

- Rental Property Investments: Explore the potential of investing in rental properties, which can generate passive income and long-term appreciation.

Career Progression and Income Growth

Middle age often coincides with the peak earning years for many professionals. As individuals advance in their careers and take on more significant roles, their income typically increases, providing more opportunities for saving and investing.

To leverage this income growth, consider the following strategies:

- Maximize Retirement Contributions: Take advantage of catch-up contributions for retirement accounts like 401(k)s and IRAs, which allow higher contribution limits for individuals aged 50 and older.

- Diversify Investments: Explore a diverse range of investment options, such as stocks, bonds, real estate, and alternative investments, to build a well-balanced portfolio aligned with your risk tolerance and time horizon.

- Debt Management: Prioritize paying off high-interest debt, such as credit cards and personal loans, to free up more disposable income for saving and investing.

Investment Growth

During the peak years, the power of compounding interest can significantly boost the growth of your investments. By consistently contributing to retirement accounts and other investment vehicles, your net worth can experience substantial growth.

To maximize investment growth, consider the following strategies:

- Asset Allocation: Periodically review and adjust your asset allocation to ensure it aligns with your risk tolerance and investment goals.

- Tax-Efficient Investing: Explore tax-advantaged investment accounts, such as 401(k)s, IRAs, and health savings accounts (HSAs), to minimize the impact of taxes on your investment returns.

- Professional Guidance: Consider working with a qualified financial advisor who can provide personalized investment advice and help you navigate complex financial decisions.

By capitalizing on the peak earning years, managing debt effectively, and implementing strategic investment strategies, individuals in middle age can significantly boost their net worth and set themselves up for a financially secure future.

The Golden Years: Preserving and Transferring Wealth

As individuals approach retirement and enter their golden years, the focus shifts from wealth accumulation to wealth preservation and transfer. During this stage, managing expenses and ensuring a stable income stream become paramount.

Retirement Income Sources

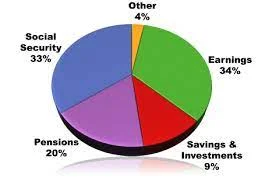

In retirement, your income sources may include:

- Social Security Benefits: Determine your eligibility and projected benefit amount based on your work history and retirement age.

- Pension Plans: If you have a traditional pension plan through a former employer, understand the distribution options and potential income stream.

- Retirement Accounts: Develop a withdrawal strategy for your 401(k), IRA, and other retirement accounts that aligns with your spending needs and tax implications.

- Investment Income: Depending on your investment portfolio, you may generate income from dividends, interest, and capital gains.

To ensure a secure retirement, it’s essential to carefully plan and manage these income sources to cover your living expenses and maintain your desired lifestyle.

Estate Planning and Wealth Transfer

As you approach the later stages of life, estate planning becomes increasingly important. Proper planning can help you preserve your wealth and ensure its smooth transfer to your intended beneficiaries.

Consider the following strategies:

- Wills and Trusts: Work with an estate planning attorney to create a will and potentially establish trusts to facilitate the distribution of your assets according to your wishes.

- Beneficiary Designations: Review and update the beneficiary designations on your retirement accounts, life insurance policies, and other assets to align with your estate planning goals.

- Charitable Giving: Explore charitable giving strategies, such as donor-advised funds or charitable remainder trusts, which can provide tax benefits while supporting causes you care about.

- Legacy Planning: Consider ways to pass on not just your financial wealth but also your values, life lessons, and family history to future generations.

By implementing a comprehensive estate plan, you can ensure that your hard-earned wealth is distributed according to your wishes and potentially minimize tax implications for your beneficiaries.

Managing Healthcare Costs in Retirement

One of the significant expenses that can impact net worth in retirement is healthcare costs. As we age, the likelihood of needing medical care and long-term care services increases, which can place a strain on financial resources.

To mitigate the impact of healthcare costs, consider the following strategies:

- Health Insurance Coverage: Evaluate your options for health insurance coverage, including Medicare, supplemental plans, and prescription drug plans.

- Long-Term Care Planning: Explore long-term care insurance policies or other financial products designed to cover the costs of nursing home care, assisted living, or in-home care services.

- Healthcare Savings Accounts: Utilize tax-advantaged accounts, such as Health Savings Accounts (HSAs), to save and invest for future medical expenses.

- Lifestyle Modifications: Adopt a healthy lifestyle, including regular exercise and a balanced diet, which can help reduce the risk of chronic conditions and associated healthcare costs.

By proactively planning for healthcare expenses, you can better preserve your net worth and ensure that your retirement savings are not depleted by unexpected medical bills or long-term care costs.

Closing the Wealth Gap: Addressing Disparities

While discussing net worth trends, it’s crucial to acknowledge the significant disparities that exist across different demographics, including race, gender, and education level. These disparities are often rooted in systemic factors and historical inequities that have created barriers to wealth accumulation for certain groups.

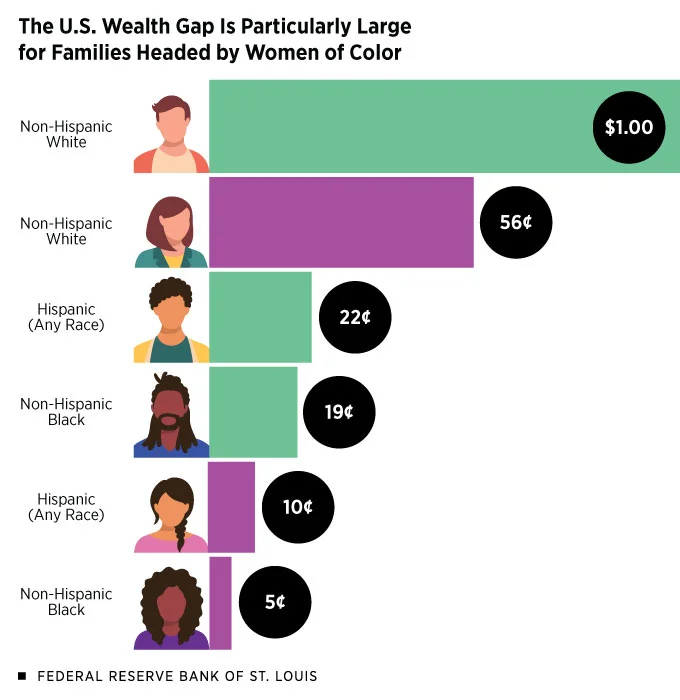

Racial Wealth Gap

According to the Federal Reserve’s Survey of Consumer Finances, the median net worth of white households is significantly higher than that of Black and Hispanic households. This gap is driven by a multitude of factors, including:

- Intergenerational Wealth Transfer: Due to historical discrimination and marginalization, many Black and Hispanic families have had limited opportunities for wealth accumulation and transfer across generations.

- Educational Disparities: Disparities in access to quality education and the associated income and employment opportunities can perpetuate the wealth gap.

- Housing Discrimination: Practices such as redlining and discriminatory lending practices have historically made it more difficult for minority communities to build home equity, a significant contributor to net worth.

Addressing the racial wealth gap requires a multifaceted approach, including investments in education, fair housing initiatives, and policies that promote economic inclusion and equity.

Gender Wealth Gap

Women often face unique challenges in building net worth, leading to a gender wealth gap. Some contributing factors include:

- Gender Pay Gap: On average, women earn less than men in many industries and occupations, which can limit their ability to save and invest over time.

- Career Interruptions: Women are more likely to take time off from their careers for caregiving responsibilities, which can impact their earnings and retirement savings.

- Longer Life Expectancy: Women generally have longer life expectancies, which means their retirement savings need to stretch further to cover longer retirement periods.

Closing the gender wealth gap requires efforts to address pay inequity, provide better support for working parents, and promote financial literacy and empowerment for women.

Education and Income Disparities

Individuals with higher levels of education and income generally have greater opportunities for wealth accumulation. Those with lower levels of education and income may face barriers such as:

- Limited Access to Financial Literacy Education: Lack of exposure to personal finance concepts and strategies can hinder effective wealth-building efforts.

- Fewer Investment Opportunities: Lower incomes may leave little room for saving and investing, limiting the potential for compound growth.

- Debt Burdens: Higher levels of student loan debt and consumer debt can impede net worth growth for those with limited financial resources.

Addressing these disparities requires a multi-pronged approach, including improving access to quality education, promoting financial literacy programs, and creating pathways to higher-paying jobs and career advancement opportunities.

While the challenges are complex, acknowledging and addressing these disparities is crucial for promoting financial equity and ensuring that everyone has the opportunity to build and preserve their net worth.

People Also Ask

- What is the average net worth by age in the United States?

The average net worth by age in the United States varies significantly across different age groups. According to the Federal Reserve’s Survey of Consumer Finances, the median net worth for individuals aged 35-44 is around $91,000, while for those aged 65-74, it is approximately $266,000. - At what age do Americans typically reach their peak net worth?

Most Americans reach their peak net worth during their late 50s or early 60s. This period coincides with the highest earning potential, significant asset accumulation, and debt repayment. - How does home-ownership impact net worth across different age groups?

Home ownership is a significant contributor to net worth growth, particularly for middle-aged and older individuals. As mortgages are paid down and home equity builds up, home-ownership can account for a substantial portion of an individual’s net worth. - What are the best investment strategies for building net worth at different life stages?

The best investment strategies may vary depending on an individual’s age and risk tolerance. In general, younger individuals can afford to take on more risk and invest more aggressively in stocks and other growth-oriented assets. As individuals approach retirement, they may want to shift towards a more conservative portfolio with a greater emphasis on fixed-income investments and preservation of capital. - How can individuals effectively manage debt to increase their net worth?

Effective debt management is crucial for increasing net worth. Strategies include prioritizing the repayment of high-interest debt (such as credit cards), negotiating lower interest rates, consolidating debt, and avoiding taking on new debt. Additionally, maintaining a healthy debt-to-income ratio and regularly monitoring credit reports can help improve overall financial health.

Conclusion

Visualizing and understanding the net worth of Americans by age is a crucial step in effective financial planning and wealth management. Throughout this comprehensive guide, we’ve explored the definition of net worth, its significance, and the factors that influence it.

We’ve delved into the unique challenges and opportunities faced by different age groups, from the millennial dilemma of student loan debt and delayed milestones to the peak earning years of middle age and the wealth preservation strategies for retirement.

Furthermore, we’ve addressed the disparities in net worth across different demographics, acknowledging the systemic factors and historical inequities that have contributed to these gaps. Closing these gaps requires a multifaceted approach, involving investments in education, fair housing initiatives, and policies that promote economic inclusion and equity.

Ultimately, the journey towards building and preserving net worth is a lifelong endeavor that requires consistent effort, strategic planning, and a commitment to financial literacy and responsible money management. By understanding the trends, implementing effective strategies, and making informed decisions, individuals can take control of their financial futures and work towards achieving their desired level of financial security and prosperity.

Remember, your net worth is a reflection of your financial journey, and by taking proactive steps today, you can shape a brighter and more secure tomorrow.