8 Timeless Lessons from Rich Dad Poor Dad

Over 25 years since its release, Rich Dad Poor Dad by Robert Kiyosaki remains one of the most impactful personal finance books. Here are 8 powerful lessons that still ring true today:

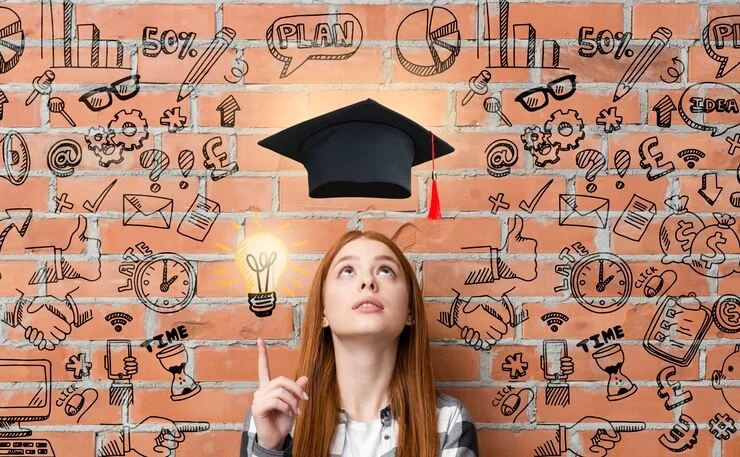

1. Financial Education is Critical

Unfortunately, most schools still do not teach personal finance skills. To gain control over your money, you need a strong financial education on topics like budgeting, investing, taxes, and building assets. Being intentional about learning money management is key.

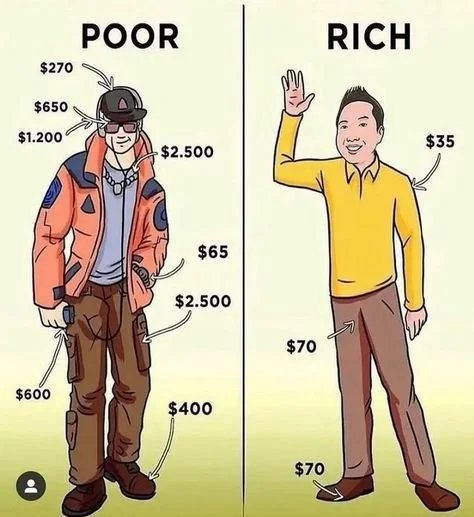

Difference between the Rich and Poor

Rich:

1st – Needs

2nd – Investments

3rd – Wants

Poor:

1st – Wants

2nd – Needs

3rd – Investments

This is the only reason the rich have their money work for them and why the poor and middle-class work for their money.

2. Mindset Matters

The rich focus first on assets and investments that make them money, while the poor prioritize liabilities and consumption. Adopting a rich mindset of owning income-producing assets is crucial. Assets put money in your pocket, liabilities take it out.

3. Change Starts Within

Blaming external factors won’t create change. Making different financial choices requires self-reflection and personal accountability. Believe you can master your money and your relationship with it will transform.

4. Leverage Accounting

Learn accounting to understand cash flow and categorize your money. Tracking income, expenses, assets and liabilities gives you clarity. Managing money without accounting is like driving blindfolded.

5. Taxes Reward the Rich

Taxes favor those who own corporations and assets. The poor pay taxes upfront on income, the rich reduce tax exposure through write-offs and other loopholes. Learning optimal tax strategies is essential.

6. Separate Your Job from Your Wealth

Depending on earned income alone limits wealth growth. Build assets and diverse income streams outside your job. View your job as funding your investments, not your lifestyle.

7. Your Mind is an Asset

In the digital age, leveraging your mind to find opportunities and make smart money moves is more valuable than ever. Develop skills like sales, marketing, and emotional intelligence.

8. General Knowledge Brings More Value

Specialization locks you into a niche and salary ceiling. Broad-based business knowledge around money, systems, and people offers more upside. Keep learning and expanding your capabilities.

While some examples are outdated, the core principles in Rich Dad Poor Dad remain timeless for achieving financial freedom. Learn these lessons and take control of your financial destiny.

9. Reject Conventional Financial Wisdom

Society pushes the idea of going to school, getting a secure job, and investing for the long term in things like mutual funds. But conventional paths often just make you rich in expenses, not assets. Question traditional financial advice.

10. Don’t Work for Money – Make it Work for You

Passive income and cash flow from assets are how the wealthy build net worth. Relying on active earned income from your job means you’re limited by your time. Shift your focus to accumulating assets.

11. Learn from Mentors

Having the right mentors accelerates your financial education. Mentors help you avoid costly mistakes and adopt financially savvy habits. Books also provide mentorship – treat Rich Dad Poor Dad as a mentor.

12. Money is Something You Manage

Becoming rich isn’t about how much money you make – it’s about how well you manage it. Focus on increasing your financial intelligence to better leverage money as a tool.

13. Get Control of Your Cash Flow

If you don’t tell your money where to go, you’ll wonder where it went. Actively managing your cash flow is essential – set budgets, automate saving and bill pay, and scrutinize expenses.

14. Invest for Capital Gains

The rich earn money when they sleep through assets and capital gains. The poor earn money through wages and pay higher taxes. Structure investments and businesses to realize capital gains.

15. Don’t Wait to Start Investing and Learning

The time is now. The earlier you start educating yourself about money management and investing, the sooner compound interest starts working for you.

Rich Dad Poor Dad empowers people of all backgrounds to break free of debt, build their wealth, and forge their own financial destiny. Master these lessons and take control of your financial future.

FAQs

Financial Education and Mindset:

Is financial education more important than formal education?

The book argues that traditional education focuses on getting a job, while financial education teaches you how to create wealth. Both are valuable, but the book prioritizes financial literacy for building wealth.

What’s the difference between an asset and a liability?

Assets put money in your pocket (e.g., rental properties, businesses), while liabilities take money out (e.g., car payments, credit card debt). The book emphasizes acquiring assets to generate passive income.

Why is having a positive money mindset important?

The book suggests that your beliefs about money influence your financial decisions. A positive mindset encourages risk-taking, learning, and financial growth.

Investing and Wealth Building:

Does the book recommend specific investment strategies?

While the book mentions various investment types (real estate, stocks), it primarily encourages readers to learn about different options and choose ones that align with their goals and risk tolerance.

Is the book promoting “get rich quick” schemes?

No, the book emphasizes building wealth through long-term strategies like acquiring assets and creating multiple income streams. It warns against quick fixes and unrealistic expectations.

What role does debt play in the book’s wealth-building principles?

The book advocates for “good debt” used to acquire income-generating assets, while discouraging “bad debt” on depreciating liabilities. Responsible use of debt can be a tool for wealth creation.

Practical Application and Criticism:

Can I apply the book’s lessons without significant capital?

The book encourages starting small and focusing on financial education before investing heavily. Small consistent actions can build wealth over time.

Are there criticisms of the book’s financial advice?

Some criticize the book’s oversimplification of complex financial concepts and its potentially risky recommendations. It’s crucial to do your research and consult financial professionals before making investment decisions.

How can I use the book’s lessons to create my own financial plan?

The book provides a framework, but financial planning is personal. Analyze your income, expenses, goals, and risk tolerance to create a personalized plan that works for you.

Remember: While “Rich Dad Poor Dad” offers valuable insights, it’s not a one-size-fits-all solution. Use it as a starting point for learning, researching different perspectives, and consulting professionals before making financial decisions.